The reintroduction of the minimum share capital in Romania: a critical analysis in the context of European trends

On August 13, 2025, Finance Minister Alexandru Nazare announced the government's intention to increase the minimum share capital for limited liability companies from 1 RON to 8,000 RON.

This proposal marks a radical shift from the policy adopted in 2020, when Romania eliminated the minimum capital requirement through Law 223/2020 at the suggestion of Claudiu Nasui, with the support of USR and PSD.

This article analyzes the proposal through the lens of available empirical evidence, focusing on three fundamental aspects: the effectiveness of minimum capital as a tool for creditor protection, the impact on the formation of new enterprises, and Romania's positioning in relation to current European practices.

The initial arguments for the removal remain valid.

Explanatory Memorandum of Law 223/2020The removal of the minimum threshold of 200 RON for the share capital of LLCs identifies fundamental issues that remain unresolved and which would reemerge in an aggravated form with the reintroduction of a threshold of 8,000 RON.

The main argument was that "the excessive bureaucracy currently governing the transfer of shares has extremely harmful effects in general" and that the cumbersome transfer procedure, which could take up to 60 days due to the possibility of opposition from any interested party, represented "an additional blockage in the business environment."

The document emphasized that "the share capital, although referred to as the 'general collateral of unsecured creditors', is not held as a reserve at the disposal of potential creditors" and that "it represents nothing more than another element in the company's balance sheet." Furthermore, the explanatory memorandum noted the positive effects observed in countries that have eliminated minimum thresholds, citing the CJEU case law regarding the freedom of establishment.Centros, C-212/97; Inspire Art, C-167/01).

These arguments - the inefficiency of minimum capital as protection for creditors, excessive bureaucratization of the business environment, and the need to align with modern European practices - remain just as valid today. Reintroducing a threshold 40 times higher than the one that was eliminated would mean disregarding the conclusions that Romania reached only five years ago.

The European context: a clear trend towards liberalization

To understand the significance of the Romanian proposal, it is essential to examine recent developments in European corporate law. The comprehensive study conducted by Martin Gelter (2024) systematically documents reforms in 31 European countries between 1995 and 2020, noting that "many European countries have reduced or abolished minimum capital requirements during this period."Gelter 2024, p. 3).

- France It was among the first countries to make this radical decision. In 2003-2004, the minimum capital requirement for LLCs was abolished, allowing for incorporation with just a symbolic 1 EUR.

- Germany In 2008, the legal form Unternehmergesellschaft (UG) was introduced, allowing the establishment of a limited liability company with just 1 EUR in capital, while still retaining the traditional GmbH form with the requirement of 25,000 EUR for those who prefer this option.

- Netherlands In 2012, it went even further by completely eliminating the minimum capital requirement for BV (Private Limited Company) and introducing a much more efficient "distribution test."Library of Congress).

- Belgium It followed the example in 2019, removing the previous requirement of €18,550 for SPRL/BV and replacing it with a mandatory financial plan and the directors' liability for evident undercapitalization.Jones Day).

- Italy It dramatically reduced the requirements in 2013 by introducing the S.r.l.s. form with a capital starting from 1 EUR, while Romania itself eliminated the minimum threshold in 2020.

Theoretical critique of minimum capital

The academic literature in the field of corporate law provides a consistent critique of the effectiveness of minimum capital as a protective instrument. Enriques and Macey (2001) argue in the Cornell Law Review that "minimum capital requirements do not serve the function of capital formation" and that "legal capital rules fail to effectively protect creditors."

The fundamental problem identified lies in the static nature of the minimum capital compared to the dynamic risks of a business. The capital contributed at the establishment can be immediately utilized in the company's current operations - for paying rent, purchasing goods, or covering salaries. There is no legal obligation to maintain this amount intact as a reserve for creditors.

Armour (2006) expands on this critique in the European Business Organization Law Review, noting that "minimum capital requirements are both excessively broad and insufficiently comprehensive: they impose costs on all firms, regardless of their risk profile, while failing to ensure adequate capitalization for high-risk enterprises."

Empirical evidence regarding economic impact

Gelter econometric model

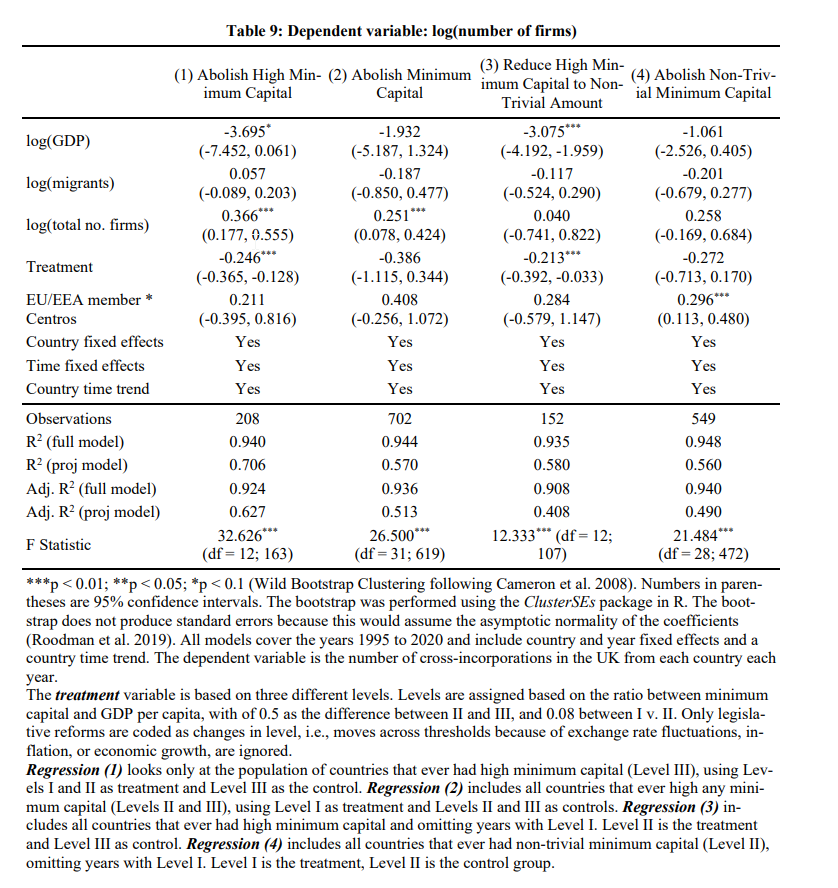

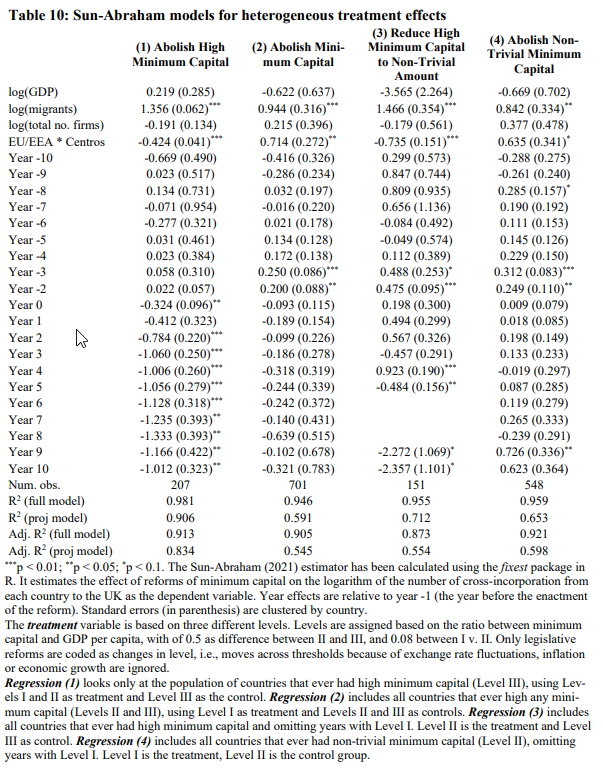

The econometric analysis conducted by Gelter (2024) provides concrete evidence regarding the effects of capital requirements on corporate mobility. Using a fixed effects regression model on a panel of 31 countries, the study identifies "a coefficient of 1.312 (p < 0.01) for the logarithm of the ratio of minimum capital to GDP per capita."p. 26).

This elasticity suggests that a 10% increase in the ratio of minimum capital to GDP per capita is associated with a 13.12% increase in the number of cross-border incorporations.

Application for Romania

To contextualize these figures in the case of Romania, specific parameters need to be calculated:

- At the exchange rate of 5.064 RON/EUR (August 2025), the amount of 8,000 RON is approximately equivalent to 1,580 EUR.

- Relative to Romania's GDP per capita (approximately €19,444), this amount represents 8.12%.

- This report places Romania in the category of "non-trivial" requirements according to Gelter's classification, which sets the threshold at 8% of GDP per capita.

It is important to note that the effects documented by Gelter are more pronounced for countries with "high" requirements (over 50% of GDP per capita). For the category in which Romania would fall, the evidence is more nuanced - Table 9 of the study shows that the transition from trivial to non-trivial requirements does not produce statistically significant effects across all model specifications.p. 36).

The German case: a favorable experiment

Germany provides a particularly relevant case study. Following the introduction of the UG form in 2008, Gelter documents a drastic decline in German companies registered in the UK: "German cross-border incorporations in the UK fell from an average of 6,586 per year during the period 2006-2010 to 1,782 during the period 2011-2015."p. 15).

This 73% reduction suggests that when domestic barriers become reasonable, entrepreneurs prefer to remain within their own jurisdiction. However, the direct application of this precedent to Romania requires caution - Germany had a significant pre-existing phenomenon of German "Limiteds" (over 4,500 firms annually before the reform), while Romania has never experienced such a large-scale corporate exodus.

The current situation in Romania: data and trends

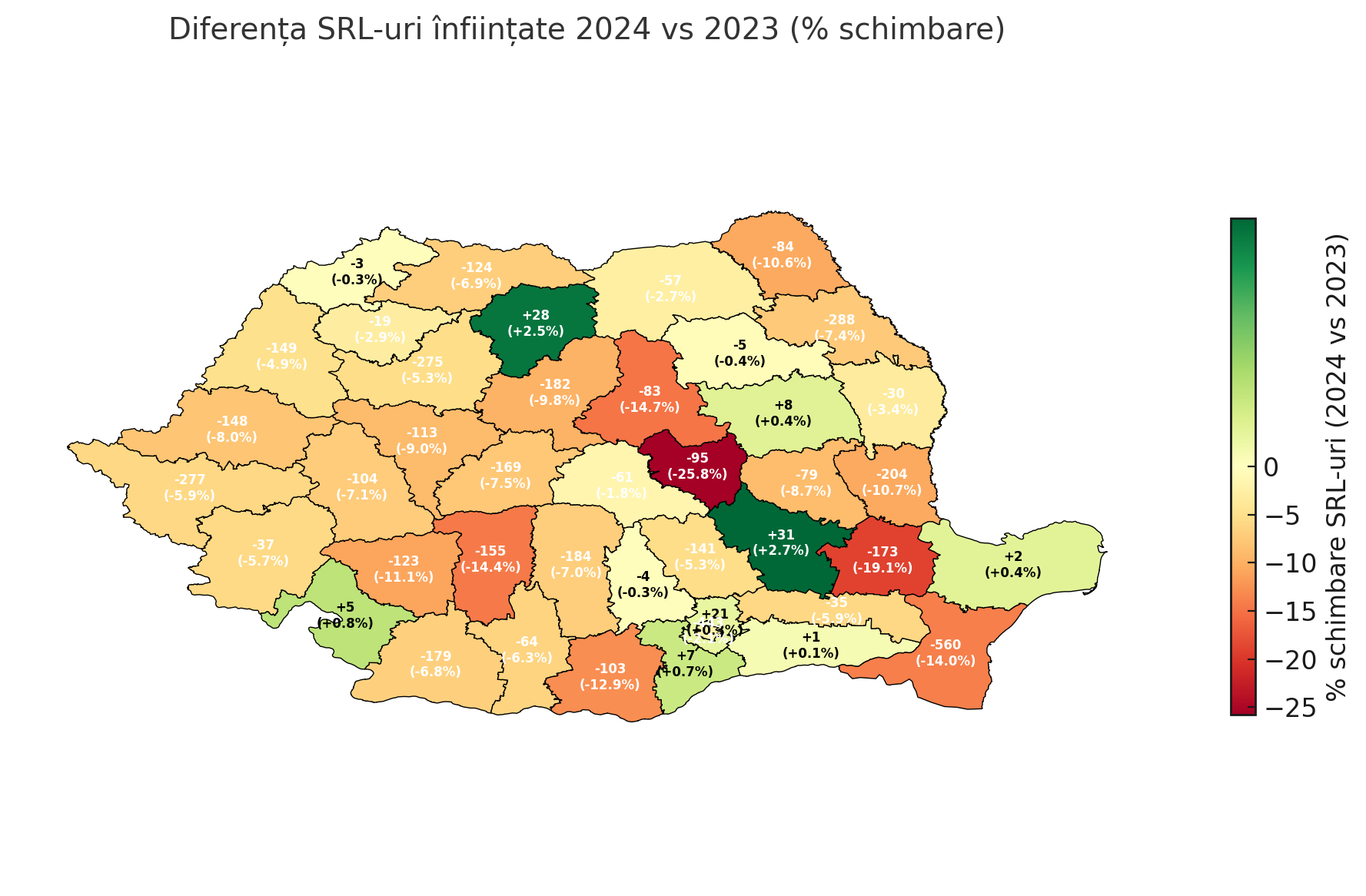

Comply with the data ONRCIn 2024, 91,619 limited liability companies were registered, compared to 96,266 in 2023 - a decrease of 4.83%. This downward trend, in a challenging economic context, raises questions about the appropriateness of introducing additional barriers.

The geographical distribution of registrations reveals significant disparities:

- Bucharest and Ilfov account for 30.5% of the total new LLCs (27,959 out of 91,619 in 2024)

- Counties such as Teleorman (-23.48%), Mehedinți (-8.81%), and Vaslui (-15.13%) have recorded significant declines compared to the previous year.

The introduction of an additional financial barrier could exacerbate these already concerning regional disparities.

Modern alternatives for minimum capital

Countries that have eliminated minimum capital requirements have not left creditors unprotected. On the contrary, they have adopted more sophisticated and effective instruments.

- Belgium has replaced the capital requirement with the obligation to prepare a detailed financial plan. Founders must prepare a plan that covers at least the first two years of operations, and directors may be held personally liable if the company fails within three years due to evident undercapitalization.Jones Day).

- The Netherlands employs a "distribution test" that conditions any distribution to shareholders on the company's ability to meet its debts due within the next 12 months. This mechanism provides dynamic and ongoing protection, unlike the static amount contributed at incorporation.Library of Congress).

Implications for Romanian public policy

The proposal to increase the minimum share capital to 8,000 RON must be assessed in relation to the stated objectives and available alternatives.

If the goal is creditor protection, the evidence suggests that modern tools - solvency tests, extended liability for managers, mandatory financial plans - are more effective than an arbitrary financial barrier.

If the goal is to combat "shell" companies, international experience does not support the idea that a high minimum capital reduces fraud. Gelter notes that "empirical evidence does not support a strong correlation between minimum capital requirements and the incidence of corporate fraud."p. 40).

Lessons from Recent European Reforms

Braun et al. (2013), analyzing the reforms in Spain, France, Hungary, Germany, and Poland, note that "the reforms in each country have made the 'reformed' national type of legal entity relatively more popular" (quoted in Gelter 2024, p. 11The reduction of barriers has stimulated local entrepreneurship and has not led to a deterioration of the business environment.

Furthermore, Gelter's study demonstrates that "removing high capital requirements reduces external mobility by approximately 20%."p. 37suggesting that entrepreneurs prefer to establish companies in their own jurisdiction when conditions are reasonable.

Conclusions

The analysis of the proposal to increase the minimum share capital in light of the available evidence leads to several clear conclusions:

- The documented European trend is unequivocal. - on reducing or eliminating minimum capital requirements. Romania would be making an unusual move compared to the trends of the last two decades.

- The theoretical foundation of the measure is problematic - The protection offered by minimum capital is largely illusory, as the amounts paid in can be immediately used in current operations. As Enriques and Macey note, "adjustable creditors can negotiate for contractual protection, while non-adjustable creditors may refuse to do business with undercapitalized firms."p. 1195).

- Modern alternatives offer superior protection - The instruments adopted by developed countries protect creditors more effectively without imposing entrepreneurial barriers. These instruments deserve exploration before reverting to a mechanism whose inefficiency has been demonstrated both theoretically and empirically.

In the absence of solid arguments justifying a departure from European trends and the disregard for well-founded academic critiques, the proposal to increase the minimum share capital appears to be a step backward for the Romanian business environment. Perhaps, before implementation, a broader debate on the objectives pursued and the optimal tools for achieving them would be beneficial.

Bibliography

Armour, J. (2006). „Legal Capital: An Outdated Concept?" European Business Organization Law Review, 7(1), 5-27. Text Integral

Braun, R., Eidenmüller, H., Engert, A., & Hornuf, L. (2013). „Does Charter Competition Foster Entrepreneurship? A Difference-in-Difference Approach to European Company Law Reforms." Journal of Common Market Studies, 51(3), 399-415. Text integral

Enriques, L., & Macey, J. R. (2001). „Creditors Versus Capital Formation: The Case Against the European Legal Capital Rules." Cornell Law Review, 86(6), 1165-1204. Text integral

Gelter, M. (2024). „Minimum Capital and Cross-Border Firm Formation in Europe." Journal of Law, Finance, and Accounting, 8 (forthcoming). ECGI Law Working Paper N° 748/2024. SSRN: 4683041

National Trade Register Office. (2024). Registrations - annual and monthly statistics. ONRC

Note: All citations from Gelter (2024) refer to the working paper version available as ECGI Law Working Paper No. 748/2024, SSRN: 4683041. The page numbers correspond to this version.

Recommended charts (Gelter):